US tech companies expanding into Canada enjoy access to a thriving economy, a growing tech talent pool, and streamlined immigration programs that can be a welcome relief from US immigration programs like the H-1B. Yet, while Canadian business culture shares many similarities with the US, navigating the major differences in employment law, including compliance with the Canada Labour Code for federally regulated employees, is essential to make sure the foreign business is compliant. Additionally, businesses must understand and comply with Canadian labor laws, which can vary significantly across different provinces, posing challenges for companies expanding their operations.

If a US company wants to open a Canadian office, they will need to make sure they have the right staff to help with administration, especially employment laws, HR, payroll, and more, which can be a financial and logistical burden. Partnering with a Canadian Professional Employment Organization (PEO) can offer the support needed for a smooth transition and allow the company to focus on hiring talent and managing the business.

In this article, we highlight some of the major differences between US and Canadian employment and why, in some cases, a US company may want to leverage a Canadian PEO to help handle some of the technical aspects of having a Canadian office.

Key employment law differences between the US and Canadian labor laws

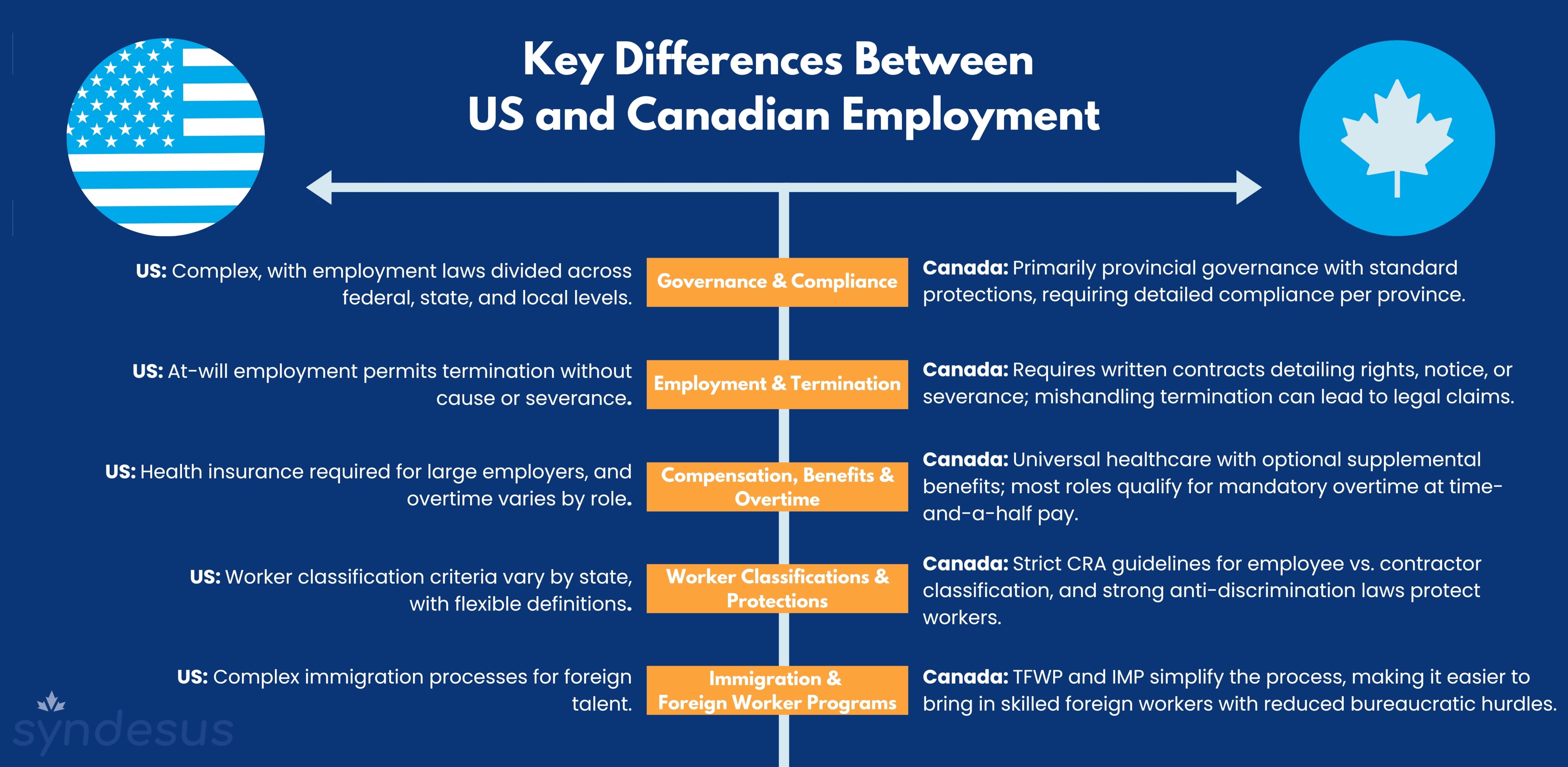

In the US, employment rules are split between local, state, and federal levels, making things a bit complicated. But in Canada, it’s a bit simpler. Provinces handle most employment matters, except for certain industries overseen by the federal government. Each province has its own rules — they’re mostly standard across the country — except in Quebec, which has a civil law system, unlike the common law system elsewhere in Canada. British Columbia, for example, has specific regulations regarding anti-discrimination protections, personal information protection, overtime regulations, sick leave entitlements, and statutory benefits.

Additionally, the Employment Equity Act requires federally regulated employers to report salary data to reveal any wage gaps among demographics, promoting fair pay for women, minority groups, and persons with disabilities.

Canada tends to lean more towards protecting employees, especially when it comes to things like accommodation rights, restrictions on what employees can and can’t do, and how terminations are handled.

At the end of the day, companies should know the key differences between employment in the US and Canada before opening a Canadian office, as minor differences in American and Canadian employment can pose significant legal risks. Please note, this article is not legal advice, and if you have questions regarding employment law in either the US or Canada, please contact a qualified employment attorney!

Let’s dive in.

Employment agreements and employment contracts

In Canada, the employment relationship is typically governed by detailed written employment contracts, which outline the terms of employment, including salary, benefits, job responsibilities, and termination clauses. Unlike the US, where at-will employment is common and contracts are often less formal, Canadian employment contracts are crucial for clarifying the rights and obligations of both parties. These contracts must comply with provincial labor laws, which can vary significantly, making it essential for US companies to seek local legal expertise when drafting these agreements.

In Canada, written employment contracts are not merely recommended but considered standard practice, which isn’t always the case in the US. Companies that start operations in Canada shouldn’t rely on the existing employment agreements they use in the US, as many clauses related to pay, dismissal, and vacation time may differ.

There are also different rules with regard to what counts as an independent contractor and what counts as an employee. Employers have to be careful not to be liable for a contract worker’s vacation pay, overtime, and other statutory minimums. It’s always best to work with a professional who understands Canadian employment laws when drawing up contracts for staff in Canada. Additionally, compliance with Canadian employment laws is crucial when hiring employees to ensure all legal requirements are met.

Canadian termination vs. at-will employment and severance pay

Unlike the common at-will employment system in the US, wherein both employer and employee can generally terminate the relationship without cause, Canada operates differently. To terminate employees in Canada, employers must adhere to specific standards, including providing valid reasons for termination and appropriate notice periods. Severance pay is also a critical component, ensuring that employees receive fair compensation in termination cases.

Except when ‘just cause’ exists (indicating egregious misconduct), Canadian workers are usually entitled to substantial prior notice of termination or otherwise receive monetary compensation in lieu of that notice. The required length of notice depends on several factors, such as the employee’s tenure, role, age, and ease of finding comparable work. Incorrectly handling termination could easily trigger wrongful dismissal claims against an employer, so consulting with a legal professional first is advised.

Compensation

There are many ways the US and Canada differ regarding benefits and compensation. Canada’s federal minimum wage, like the US, can differ by province or territory. Minimum wages are adjusted annually to account for economic factors like inflation, and employers need to observe the higher applicable rates based on where the work occurs. Employment insurance is another statutory benefit in Canada, requiring employers to make mandatory deductions and contributions under the employment standards legislation. Likewise, salary structures, bonus schemes, and equity-based compensation need careful alignment with fair practice rules within Canadian provinces.

Another key difference is that employers in Canada are required to keep hold of payroll records for six years, whereas it can differ in the US at the federal level, though the IRS (the US’s main tax agency) requires payroll records to be kept for four years.

In the US, employers with 50 or more employees are required to provide their employees with health insurance, or risk paying a fine to the IRS. In Canada, because Canadian provinces provide universal health care, health insurance is not mandatory. However, many employers offer supplemental insurance as an employment benefit.

Minimum Wage in Canada

Understanding minimum wage regulations is crucial for US companies expanding into Canada. Unlike the United States, where the federal minimum wage sets a baseline and states can establish higher rates, Canada’s minimum wage is determined at the provincial and territorial level. Each province and territory has the authority to set its own minimum wage, reflecting regional economic conditions and living costs. This decentralized approach means that employers must stay informed about the specific minimum wage requirements in each location where they operate.

Overtime rules

Unlike the US, Canada doesn’t have “exempt” and “non-exempt” jobs for overtime. Most Canadian employees, regardless of salary or title, are entitled to overtime pay unless a specific exemption applies. The Canada Occupational Health and Safety Regulations play a crucial role in ensuring workplace safety, emphasizing the importance of occupational health. Working beyond a pre-established limit (typically 40-44 hours per week) incurs mandatory overtime pay at the rate of “time-and-a-half.”

Careful oversight and adherence to overtime rules are important in Canada to avoid breaching employment law, because even if a job doesn’t fit a standard overtime exemption, employers and employees can agree on ways to lower overtime costs, such as paid time off in lieu, in an employment contract.

Vacation policy

Canadian federal law stipulates a legal minimum for paid vacation accrual, ordinarily starting at a baseline of two weeks per year. An employee’s vacation entitlements will also grow progressively throughout the employee’s duration of service. Additionally, statutory holidays add to the overall paid time off available. This contrasts with the United States, where the federal level lacks paid vacation mandates, and time off is often provided as a benefit.

Employment Insurance and Benefits

Canadian workers are entitled to employment insurance (EI), a federal program that provides temporary financial assistance to unemployed individuals, those on parental leave, or those who are sick. Employers in Canada must contribute to EI, and failure to comply with these statutory deductions can lead to legal repercussions. This contrasts with the US system, where unemployment benefits are managed at the state level with varying requirements and benefits.

Canada Pension Plan

The Canada Pension Plan (CPP) is a mandatory public pension system providing retirement, disability, and survivor benefits, differing significantly from the US Social Security system. In Canada, both employers and employees must contribute to the CPP, with the 2024 contribution rate set at 5.95% of earnings, matched equally by employers, unlike the US where the rates are slightly different and capped differently. The CPP also includes benefits for disabilities and survivors, which contrasts with the US system’s structure and benefits. For US companies expanding into Canada, understanding these distinctions and ensuring compliance with CPP regulations, such as proper deductions and remittances to the Canada Revenue Agency (CRA), is essential. Partnering with a Professional Employment Organization (PEO) can streamline this process and ensure adherence to Canadian employment laws.

Differentiating Employees and Independent Contractors

Another critical area is the distinction between employees and independent contractors. Misclassifying an employee as an independent contractor can lead to significant legal and financial consequences in Canada. Employees are entitled to benefits such as overtime pay, vacation pay, and employment insurance, whereas independent contractors are not. The Canada Revenue Agency (CRA) uses specific criteria to determine the nature of the working relationship, including the degree of control, ownership of tools, and the opportunity for profit. US companies must carefully assess these factors to avoid potential disputes and ensure compliance with Canadian regulations.

Managing Employment Relationships

Effective management of employment relationships in Canada involves understanding and adhering to local labor laws, which prioritize employee protections. This includes providing reasonable notice or severance pay upon termination, addressing workplace accommodations, and ensuring fair treatment across various demographics. For US companies, leveraging a Canadian Professional Employment Organization (PEO) can provide invaluable support. A PEO can manage HR functions, ensure compliance with local laws, and help navigate the complexities of employment insurance, contracts, and worker classification.

Workplace Health and Safety

Workplace health and safety are paramount in Canada, with stringent regulations designed to protect workers. The Canada Labour Code, along with provincial health and safety legislation, mandates that employers provide a safe work environment. This includes regular workplace inspections, safety training programs, and immediate reporting and addressing of hazards. Failure to comply with these regulations can result in severe penalties and legal action. Unlike the US, where OSHA (Occupational Safety and Health Administration) oversees federal health and safety standards, Canada’s approach involves both federal and provincial oversight, requiring employers to be well-versed in the specific regulations applicable to their location and industry.

Hiring Foreign Workers

Employing foreign workers in Canada involves navigating the Temporary Foreign Worker Program (TFWP) and the International Mobility Program (IMP). These programs ensure that foreign workers are treated fairly and that their employment does not negatively impact the Canadian labor market. Employers must obtain a Labour Market Impact Assessment (LMIA) for most positions under the TFWP, demonstrating that no Canadian workers are available for the job. Additionally, work permits are required, and in some cases, employers must commit to meeting specific wage and working conditions. Compared to the US immigration system, Canada’s process is generally seen as more streamlined and supportive of skilled immigration, making it attractive for companies looking to tap into global talent pools.

Temporary Foreign Worker Program (TFWP)

The TFWP is designed to allow Canadian employers to hire foreign nationals to fill temporary labor and skill shortages. The program requires employers to obtain an LMIA, which assesses the impact of hiring a foreign worker on the Canadian labor market. The LMIA process ensures that the hiring of foreign workers does not displace Canadian employees or lower working conditions. Employers must demonstrate that they have made efforts to recruit and train Canadian citizens or permanent residents before turning to foreign workers.

International Mobility Program (IMP)

The IMP, on the other hand, allows employers to hire foreign workers without an LMIA under specific circumstances, such as international trade agreements, intra-company transfers, and reciprocal agreements. This program facilitates the entry of skilled workers and professionals who can contribute to the Canadian economy. The IMP is particularly beneficial for companies looking to transfer key personnel from their international branches to their Canadian offices.

Documentation and Compliance

Employers must ensure that all foreign workers have the necessary documentation, such as a valid passport or work permit, to work legally in Canada. This documentation is crucial for individual employees to prove their eligibility to work and for employers to maintain compliance with immigration and employment laws. Failure to secure the proper documentation can result in legal penalties and disrupt business operations.

Fair Treatment and Employment Standards

The TFWP and IMP both emphasize the fair treatment of foreign workers. Affected employees, whether under the TFWP or IMP, are entitled to the same protections and benefits as Canadian employees. This includes adherence to the Employment Standards Act (ESA) provisions, such as minimum wage, working hours, overtime pay, and leave entitlements. Canadian employers must ensure that their foreign employees working in Canada receive equitable treatment and are not subjected to exploitative practices.

Streamlined and Supportive Process

Compared to the US immigration system, Canada’s process for hiring foreign workers is generally seen as more streamlined and supportive of skilled immigration. This approach makes Canada an attractive destination for companies looking to tap into global talent pools. The Canadian government has implemented measures to facilitate the entry of skilled workers, recognizing the importance of international talent in driving economic growth and innovation.

The Canadian Human Rights Act

The Canadian Human Rights Act (CHRA) is a cornerstone of Canadian employment law, aimed at preventing discrimination and promoting equality in the workplace. The CHRA prohibits discrimination based on race, national or ethnic origin, color, religion, age, sex, sexual orientation, gender identity or expression, marital status, family status, disability, and conviction for which a pardon has been granted. Employers must ensure that their policies and practices comply with the CHRA to create an inclusive workplace. This involves not only preventing discrimination but also accommodating employees’ needs, such as providing accessible workspaces for those with disabilities. Understanding and implementing these principles is crucial for US companies operating in Canada, as non-compliance can lead to significant legal challenges and damage to the company’s reputation.

Employment Standards Act

The Employment Standards Act (ESA) is a fundamental piece of legislation in Canada that governs the rights and responsibilities of employers and employees in the workplace. Each province and territory in Canada has its own ESA, tailored to reflect regional needs and economic conditions. For US companies expanding into Canada, understanding and complying with the ESA in the respective province is crucial to ensure legal compliance and foster a fair working environment.

Compliance with the ESA is mandatory for all employers operating within a province. The provincial labor ministries or departments are responsible for enforcing the ESA, investigating complaints, and ensuring that employers adhere to the regulations. Employers who fail to comply with the ESA can face significant penalties, including fines and legal action.

For US companies, it is essential to recognize that the ESA’s provisions can vary between provinces. Therefore, businesses must familiarize themselves with the specific requirements of the ESA in each province where they operate. This may involve consulting with legal experts or employment standards officers to ensure full compliance.

Termination of Employment

Termination of employment in Canada is governed by different principles compared to the US. The concept of “at-will” employment, where either party can terminate the employment relationship without cause, is not recognized in Canada. Instead, Canadian employers must provide reasonable notice or pay in lieu of notice when terminating an employee, except in cases of just cause. The length of notice depends on factors such as the employee’s length of service, age, and position within the company. Additionally, employers must comply with statutory minimum notice periods outlined in provincial employment standards legislation. Severance pay may also be required, particularly in cases of mass layoffs or long-serving employees. Mishandling terminations can result in wrongful dismissal claims, making it essential for US companies to seek legal guidance to navigate the complexities of Canadian termination laws.

Working with a PEO can streamline operations in Canada

Navigating the intricacies of Canadian employment law can be a significant hurdle for foreign companies looking to start an entity in Canada, whether that’s unfamiliar regulations regarding parental leave, sick leave, and overtime pay or complex payroll, tax, and Canada Revenue Agency submissions.

In this scenario, US companies seriously looking to open an office in Canada should consider working with a PEO that has a deep understanding of Canada’s labor laws, tax laws, immigration laws, HR rules, work culture, and more, to streamline business operations and ensure compliance with Canadian law, especially for federally regulated employers. Wage recovery assistance is also crucial in managing unpaid wages, ensuring employees are fairly compensated according to the Canada Labour Code. Especially in the early days of opening a new entity in a foreign country.

A PEO provides comprehensive business management solutions for small to mid-sized companies. They require the business to have a legal entity in the foreign country they support, and then the PEO ensures smooth functioning of the business in that country. The legal entity itself, the employees’ liability, and their work responsibilities remain with the company.

A Canadian PEO can manage the nuances of Canadian payroll processing, including correct deductions and timely tax remittance. This helps avoid errors that could invite government penalties and on the flip side, can help maximize potential tax benefits. They also have localized HR knowledge, ensuring employment contracts follow provincial norms and address aspects like hiring, termination notices, benefit structures, and anti-discrimination protections.

Working with a PEO minimizes risk, reduces administrative burdens, and frees up the US company’s resources to focus on growth and strategic initiatives, hire top tech and sales talent, and otherwise make the most of their Canadian presence.

Syndesus can help US businesses open an office in Canada compliantly

Syndesus, a Canadian company with extensive expertise in managing Canadian operations for US and global clients, can provide a streamlined, comprehensive PEO solution, whatever the situation. Syndesus helps companies with PEO services, including immigration, benefits, HR, and payroll. Your administrative processes are taken care of while you focus on expanding your workforce and moving your company forward.

Reach out to us to learn more about how we can help you!

About Marc Pavlopoulos

Marc Pavlopoulos is the CEO and Founder of Syndesus, a Professional Employer Organization that provides PEO services for US companies seeking to employ workers remotely in Canada, builds engineering teams in Canada for VC-backed startups in the US, and set-up remote offices in Canada for US companies. Additionally, Syndesus can assist foreign-born tech workers (and their US employers) with options for working remotely in Canada if they cannot stay in the US due to immigration/work visa issues.

As an American who has moved to Canada twice (for grad school and for work), Marc understands the challenges involved in starting a new life in a new country. Marc is a son of an immigrant and has great respect for people who leave their home country and seek a better life in the US or Canada.

Marc’s goal is to do everything he can to help those individuals achieve their dreams. Marc also has a second venture (Path to Canada) which helps foreign-born technical workers who cannot stay in the US (for immigration reasons) get a job and work authorization to work in Canada.