Expanding your company into a new country or managing a small business in Canada comes with new responsibilities. One of the most crucial tasks is figuring out how to offer health benefits to your Canadian employees within the context of Canada’s healthcare system.

Navigating the Canadian healthcare system can seem daunting, especially for employers trying to provide appropriate employee benefits. If you’re a US company opening a small Canadian office or a Canadian business still too small to hire a full-time HR staff, selecting a health benefits provider can feel overwhelming.

This guide will help you navigate the process of choosing a Canadian health benefits provider, ensuring that you offer the right level of coverage for your employees while also considering cost, flexibility, and ease of administration.

Understanding Canada’s Health Care System

Canada’s health care system is a publicly-funded, single-payer system that provides universal access to medically necessary hospital and physician services. This system is built on the principles of universality, comprehensiveness, and portability, ensuring that all residents have access to essential health care services. The federal government sets national standards through the Canada Health Act, while the provinces and territories have significant autonomy in managing and delivering health care services. This collaborative approach ensures that health care is tailored to meet the unique needs of each region while maintaining a consistent standard of care across the country.

Overview of the Canada Health Act

The Canada Health Act is the cornerstone of Canada’s health care system, setting out the standards for provincial and territorial health care insurance plans. The Act mandates that these plans must be comprehensive, covering all medically necessary services, and must be accessible to all residents without financial or other barriers. Additionally, the Act requires that health care plans be administered and operated on a non-profit basis by a public authority, ensuring that the focus remains on patient care rather than profit. This framework helps maintain a high standard of health care across Canada, ensuring that all residents receive the care they need.

Key Principles of the Health Care System

The key principles of Canada’s health care system are designed to ensure that all residents have access to high-quality health care services:

- Universality: Every resident of Canada is entitled to health care coverage under a public health insurance plan, ensuring that no one is left without access to necessary medical services.

- Comprehensiveness: The health insurance plans must cover all medically necessary services, including hospital care, physician services, and surgical procedures, ensuring that residents receive the full spectrum of care they need.

- Accessibility: Health care services must be accessible to all residents, without financial or other barriers, ensuring that everyone can receive care when they need it.

- Public Administration: The health insurance plans must be administered by a public authority on a non-profit basis, ensuring that the focus remains on providing high-quality care rather than generating profit.

- Portability: Residents are covered when they travel within Canada, and limited coverage is also provided for travel outside the country, ensuring that they have access to care no matter where they are.

Understanding the basics of Canadian health benefits

In Canada, while the public healthcare system covers a lot of basic medical needs, many employers offer supplementary health benefits to their employees. Canadian Medicare, a decentralized, publicly funded health system, ensures universal healthcare coverage for all citizens and permanent residents. This additional coverage often includes services such as:

Health Services in Canada

Canada’s health care system provides a wide range of health services to ensure the well-being of its residents. These services include hospital care, physician services, diagnostic tests, surgical procedures, mental health services, and prescription drugs. The system is designed to provide comprehensive care, addressing both physical and mental health needs. Mental health services, in particular, are an essential component, recognizing the importance of mental well-being in overall health outcomes. Prescription drugs are also a critical part of the health care system, ensuring that residents have access to the medications they need to manage their health conditions.

Prescription drugs

While provincial healthcare plans may cover medications provided in a hospital setting, outpatient prescription drugs are generally not covered under insured health services, which encompass essential medical care provided without financial barriers as mandated by the Canada Health Act.

Dental and vision care

Routine dental check-ups, fillings, orthodontics, and vision care, such as eyeglasses or contact lenses, are not part of Canada’s public healthcare system.

Extended care, including paramedical services, orthopedics, and mental health services

Supplemental plans often include coverage for other services aimed at maintaining overall wellness. Addressing health disparities, these plans can help bridge the gap in access to healthcare and improve health outcomes for various groups. These services are particularly important as they provide employees with access to a broader range of health support.

Emergency travel coverage

When Canadians travel outside of the country, they are not covered by provincial health insurance for medical emergencies. Many supplemental health plans cover medical costs incurred abroad, which can be crucial during international travel.

Healthcare coverage and requirements vary significantly across Canada’s provinces and territories, directly impacting how employers structure their supplementary benefits. Quebec, for instance, mandates that employers providing group insurance must include prescription drug coverage that meets or exceeds the provincial drug plan (RAMQ) requirements. British Columbia’s PharmaCare program affects how private plans coordinate prescription drug coverage, while Ontario’s OHIP+ program covers many prescriptions for residents under 25, potentially reducing employer costs for this demographic.

Private Health Insurance Options

While Canada’s public health care system provides universal access to medically necessary hospital and physician services, some services are not covered, such as dental care, vision care, and prescription drugs. To fill these gaps, many Canadians turn to private health insurance. Private health insurance options are available to cover these additional services, and many Canadians obtain this coverage through their employers or purchase it individually. This supplemental coverage ensures that residents have access to a broader range of health services, enhancing their overall health and well-being. Private insurance plays a crucial role in complementing the public system, providing comprehensive coverage that meets the diverse needs of Canadians.

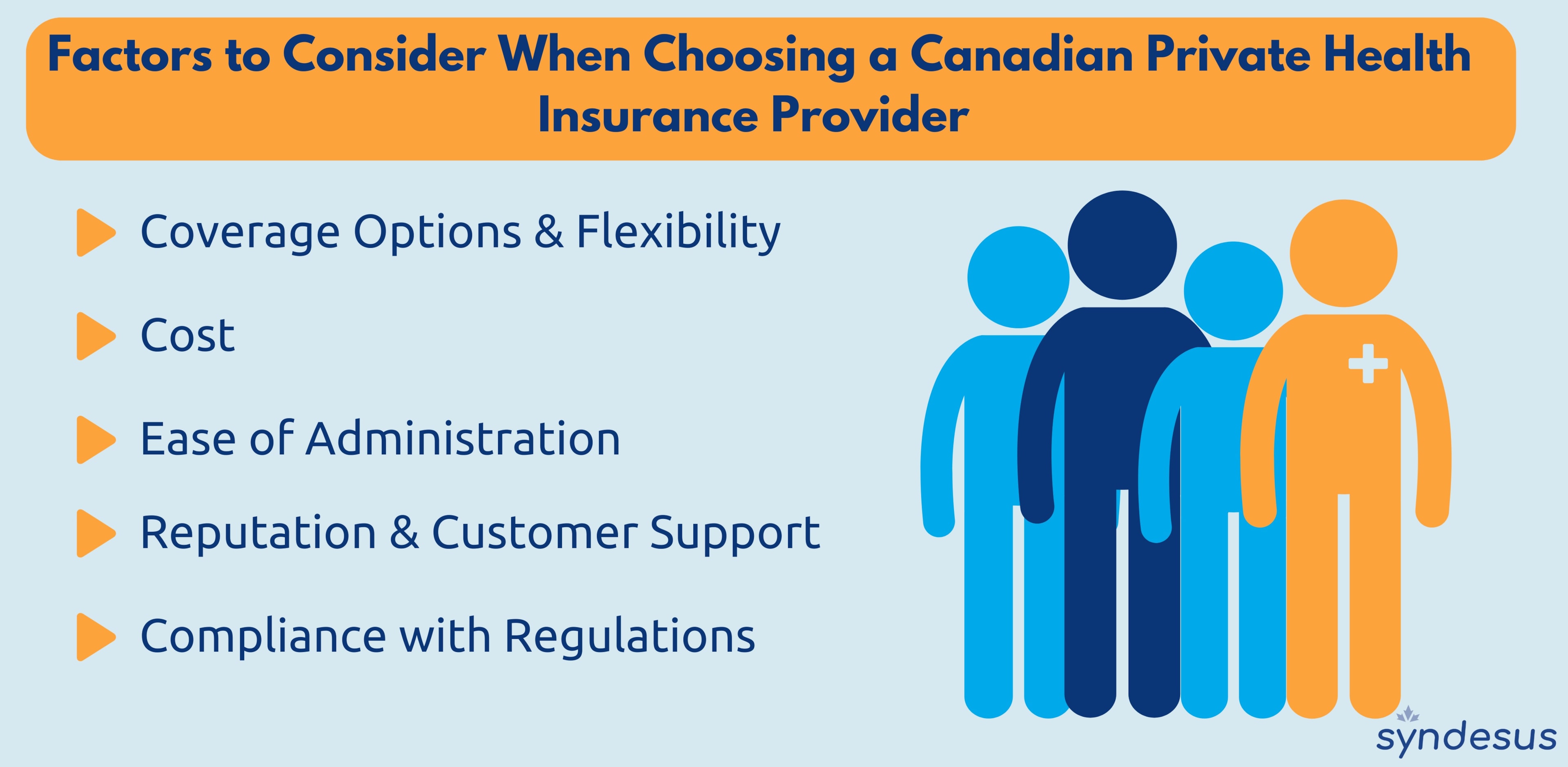

Factors to consider when choosing a Canadian private health insurance provider

1. Coverage options and flexibility

Not all health benefits packages are created equal. Some providers offer tiered plans that allow employees to choose the level of coverage that best suits their needs, while others may have rigid, one-size-fits-all plans. Evaluate your employee base to determine what kind of flexibility might be most attractive to them.

For example, if your workforce is younger and healthier, they may not need extensive coverage for paramedical services. On the other hand, if you have employees with families, you might need a plan that covers dependents and includes comprehensive dental and vision care.

2. Cost

Cost is always a consideration for small companies and new offices. The cost of health benefits in Canada can vary depending on the scope of coverage, the size of your team, and even the region where your employees are located. Providers may offer lower premiums for smaller groups or special pricing for companies just starting out.

It’s important to get quotes from multiple providers and compare the total cost—not just premiums but also deductibles, copayments, and any out-of-pocket costs that your employees might incur.

3. Ease of administration

If you don’t have dedicated HR personnel, you’ll want a benefits provider that makes administration simple. Some providers offer online platforms that allow employees to submit claims, manage their coverage, and access customer support without needing constant oversight from your team.

Many health benefits providers in Canada also have designated support staff who can help with the plan’s day-to-day administration, reducing the burden on your business and ensuring a smooth experience for your employees.

4. Reputation and customer support

Health benefits can be a critical part of employee satisfaction, so choosing a provider known for excellent customer service is essential. Research provider reviews, ask for recommendations, and even request references from other businesses in a similar size or industry to get a sense of which provider will offer the best experience.

Providers with strong customer support systems can help your company manage any issues that arise and ensure your employees are well cared for.

5. Compliance with Canadian regulations

Health benefits in Canada are subject to specific regulations and tax laws, which may differ from what you’re used to in the US. Canadian health benefits compliance involves multiple regulatory frameworks, meaning employers have to navigate provincial insurance acts, privacy laws like PIPEDA (Personal Information Protection and Electronic Documents Act), and tax regulations from the Canada Revenue Agency (CRA). Provincial and territorial governments play a crucial role in managing, organizing, and delivering health care services, contrasting their responsibilities with those of the federal government and highlighting the relationship and dynamics between the two levels of government, particularly regarding funding and service provision.

Working with a provider who understands these regulations is key to avoiding compliance pitfalls. Many providers will handle compliance issues on your behalf, ensuring that your health benefits plan remains in line with Canadian laws and regulations.

The importance of offering strong health benefits in Canada

The current competitive job market has companies with highly skilled workers offering robust health benefits that are not just nice to have—they are essential. In Canada, employees expect more than just a salary when considering a new job, and comprehensive health benefits are often a key factor in their decision-making process.

By providing strong health benefits, you signal to potential and current employees that you value their well-being. This can significantly improve your ability to attract top talent, especially in fields like technology, engineering, and finance, where competition is fierce.

Offering robust benefits is critical for attracting talent and retaining employees. Employees who feel supported through quality health coverage are more likely to stay with your company long-term, reducing costly turnover.

Additionally, a comprehensive benefits package can be a powerful marketing tool for your company. You can highlight your health benefits during recruitment efforts and on your company’s careers page as a way to differentiate your company from others.

This is especially important for US companies expanding into Canada, as Canadian employees often have different expectations regarding healthcare coverage than those in the US. Meeting or exceeding these expectations can help build your reputation as an employer.

Syndesus can help you navigate Canadian healthcare for your company

If you’re a US company expanding into Canada for the first time or a small Canadian business without a full-time HR team, choosing a health benefits provider can feel daunting. Fortunately, Syndesus is here to help.

We specialize in offering outsourced HR services, including health benefits guidance, to both US businesses expanding into Canada and small Canadian companies. We’ll work with you to understand your unique needs and help you choose the right health benefits provider for your team.

If you’re considering expanding into Canada or need assistance with managing your HR and healthcare benefits, Syndesus is here to help. Reach out for a consultation, and let’s work together to make healthcare benefits easier to navigate for both your business and employees.

*The content and materials available via Syndesus are for informational purposes only and do not constitute legal advice.