Expanding your business into Canada is an exciting opportunity for growth and access to new markets. However, it’s crucial for US companies opening offices in Canada to navigate the country’s unique landscape of human resources, benefits, labor laws, and payroll regulations. Outsourcing payroll services or hiring Canadian contractors can lead to significant cost savings, allowing businesses to achieve cost efficiency and reduce overhead expenses while navigating the complexities of international operations.

While Canadian payroll might seem similar to the US system, don’t be mistaken. There are significant differences that can impact your compliance and profitability. Correctly administering payroll in Canada is more than just legal standards; it can save your company substantial money.

Navigating Canadian Payroll Complexities

Canadian payroll involves following complicated federal and provincial regulations that differ dramatically from those in the United States.

Effective payroll management is critical in adhering to Canadian payroll laws and ensuring compliance. These include varying tax rates, mandatory contributions to programs like the Canada Pension Plan (CPP) and Employment Insurance (EI), and specific overtime and statutory holidays rules. Missteps in these areas can result in substantial fines, legal complications, and strained employee relations.

Understanding Canadian Payroll Requirements

Navigating the intricacies of Canadian payroll is essential for US companies hiring Canadian employees. The Canadian payroll system encompasses various components, including employment standards, tax laws, benefits, and deductions. The Canada Revenue Agency (CRA) plays a pivotal role in overseeing these regulations, ensuring businesses adhere to the required standards.

Understanding the nuances of Canadian payroll involves familiarizing yourself with mandatory contributions to the Canada Pension Plan (CPP) and Employment Insurance (EI), as well as the different federal and provincial income taxes. Additionally, local employment regulations dictate minimum wage, overtime, and vacation entitlements, which can vary significantly across provinces.

By comprehensively understanding these requirements, US companies can ensure compliance, avoid costly penalties, and foster positive employee relations. This foundational knowledge is crucial for setting up a compliant payroll system and managing payroll effectively.

Compliance Leads to Savings

Ensuring compliance with Canadian payroll regulations is not just about avoiding fines—it’s a powerful strategy that can drive significant savings for your company.

It is crucial for employers to accurately deduct the federal income tax along with other contributions for employees based on their respective provinces or territories.

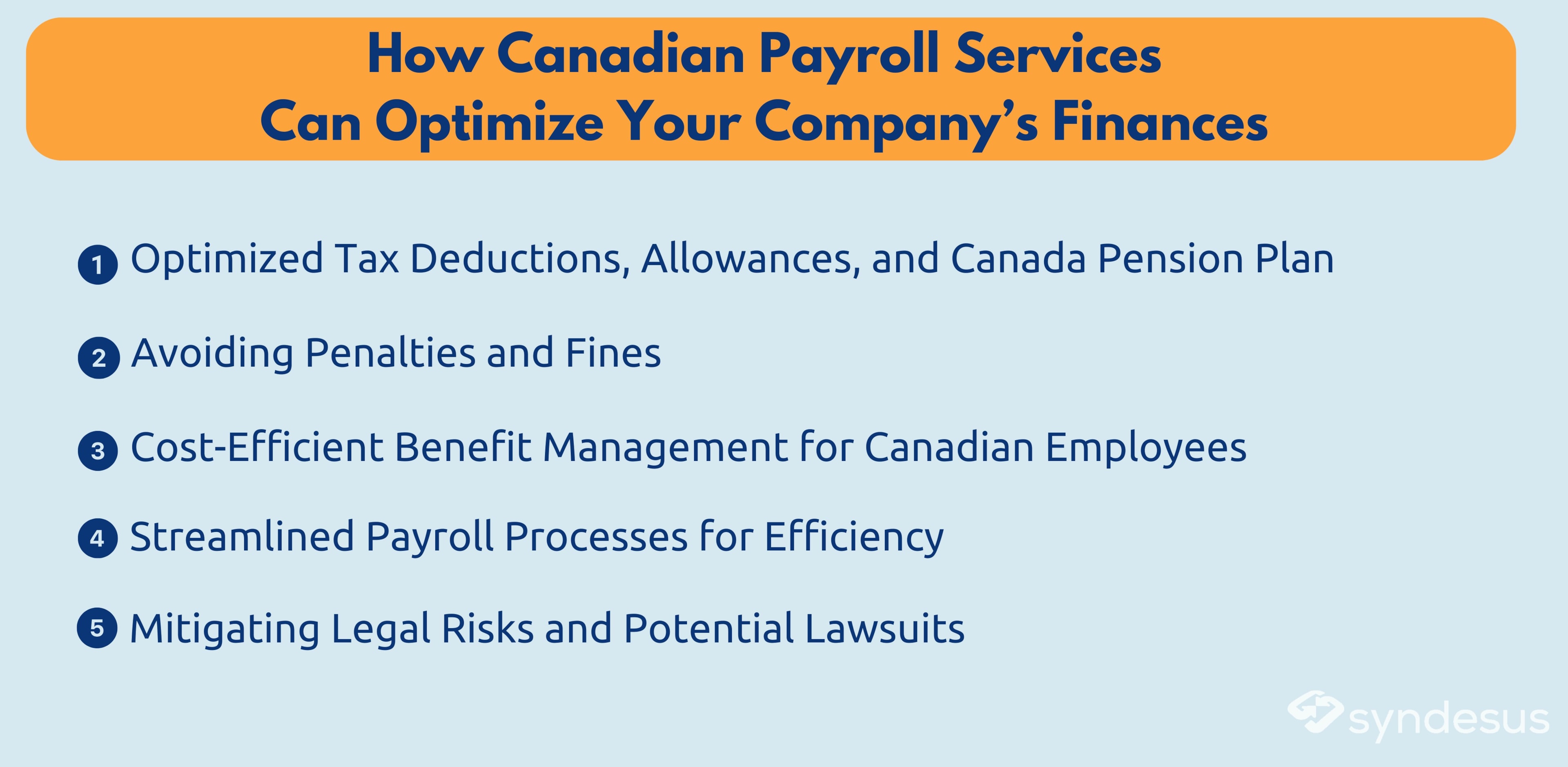

Here’s how to optimize your company’s finances through Canadian payroll services.

1. Optimized Tax Deductions, Allowances, and Canada Pension Plan

Canada’s tax system offers a variety of deductions and tax allowances, which can directly affect your company’s bottom line. By accurately applying these deductions, such as the basic personal amount (BPA) for employees, you reduce the overall taxable income for your business.

Payroll experts know which federal and provincial deductions are applicable, ensuring that your company takes advantage of all available tax breaks. Understanding and complying with varying payroll tax regulations across different provinces in Canada is crucial for avoiding legal issues and financial penalties, especially when establishing a distributed workforce.

For example, if your payroll provider is unfamiliar with taxi credits for various business aspects, such as research and development or digital media production, you may miss out on opportunities to reduce your tax liabilities.

Correctly calculating CPP (Canada Pension Plan), EI (Employment Insurance) contributions, and provincial taxes ensures that your payroll complies with legal standards while preventing overpayment.

2. Avoiding Penalties and Fines

One of the most significant ways proper payroll administration saves money is by helping you avoid costly penalties. Canada’s labor laws and tax regulations are stringent, and payroll errors—late filings, incorrect deductions, or failure to remit taxes—can lead to fines that quickly add up.

Misclassifying workers, underreporting wages, or failing to meet the deadlines for remitting taxes can each result in hefty fines, ranging from a few hundred to thousands of dollars, depending on the severity of the infraction.

In addition, improper payroll handling can attract audits from the Canada Revenue Agency (CRA), leading to potential back payments and additional penalties. Ensuring your payroll is fully compliant mitigates the risk of these unexpected and often costly events.

3. Cost-Efficient Benefit Management for Canadian Employees

When it comes to employee benefits in Canada, the line between what is mandatory and what is discretionary can be blurred. Understanding Canadian employment laws allows you to provide competitive compensation packages without overcommitting financially.

US companies face complexities when hiring and paying Canadian workers, making it crucial to understand Canadian employment laws and payroll systems.

Some benefits, such as contributions to the CPP or Employment Insurance (EI), are required by law, but others, like extended health benefits, are not mandatory.

Knowing the distinction between mandatory and optional benefits allows you to craft an attractive offer that fits your budget. For example, in some provinces, employers must offer paid vacation and public holiday pay, but there is no requirement to provide additional health insurance or retirement plans.

Outsourcing payroll to experts helps you navigate these rules, ensuring you meet all legal obligations while avoiding unnecessary costs.

4. Streamlined Payroll Processes for Efficiency

Although handling payroll in-house may seem like a cost-saving measure, it often results in inefficiencies, errors, and wasted time—especially for companies unfamiliar with the Canadian system.

When U.S. companies hire Canadian employees, they gain access to Canada’s skilled workforce while ensuring compliance with labor laws, payroll, and tax systems to avoid penalties associated with misclassification of workers. Payroll outsourcing allows for more streamlined and accurate processing, reducing administrative overhead. A team of specialists who understand the nuances of Canadian labor and tax laws can minimize errors and complete tasks faster.

This efficiency translates into financial savings, as your internal team now has time to focus on other strategic areas of business growth rather than spending time navigating complex payroll requirements.

Additionally, outsourcing can eliminate the need for expensive payroll software or in-house staff, reducing overhead costs.

5. Mitigating Legal Risks and Potential Lawsuits

Non-compliance with payroll laws can lead to more than financial penalties—there’s also the risk of lawsuits from employees who feel they’ve been underpaid or unfairly treated.

In Canada, employees are entitled to strict protections under provincial and federal labor laws, and failure to comply with these regulations can lead to costly legal battles.

Ensuring compliance with employment standards—such as providing proper overtime pay, following termination notice requirements, and issuing timely and accurate pay stubs—protects your company from the risk of litigation.

By outsourcing payroll to professionals well-versed in Canadian labor laws, you can rest assured that your company remains legally protected, saving you from potential legal expenses.

Setting Up a Compliant Payroll System

Setting up a compliant payroll system is crucial for US companies hiring Canadian employees. This involves understanding the various components of Canadian payroll, including employment standards, tax laws, benefits, and deductions. The Canada Revenue Agency (CRA) plays a pivotal role in overseeing payroll regulations, ensuring that businesses adhere to these standards.

To set up a compliant payroll system, US companies must:

- Register for a Canadian Business Number (BN) and obtain a payroll program account with the CRA: This is the first step in establishing a legal presence in Canada and ensuring all payroll activities are tracked and reported correctly.

- Understand the different types of payroll taxes: This includes federal and provincial income taxes, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums. Each type of tax has specific rates and remittance schedules that must be followed.

- Determine the correct payroll deductions and remittances: Accurate calculation and timely remittance of CPP, EI, and federal and provincial income taxes are essential to avoid penalties and ensure compliance.

- Implement a payroll system that can accurately calculate and process payroll deductions and remittances: Investing in reliable payroll software or partnering with a payroll service provider can streamline this process and reduce the risk of errors.

- Ensure compliance with local employment regulations: This includes adhering to minimum wage laws, overtime pay, and vacation entitlements, which can vary by province.

By setting up a compliant payroll system, US companies can avoid costly penalties and ensure that their Canadian employees are paid accurately and on time.

The Advantage of Outsourcing Canadian Payroll

By outsourcing your Canadian payroll to experts, you ensure compliance with all local laws and regulations while tapping into cost-saving opportunities.

Payroll management professionals stay updated on the latest legal changes, leverage technology for efficient processing, and provide insights into financial optimization. Dedicated payroll services can aid businesses in navigating the complexities of Canadian payroll, ensuring accuracy and enhancing employee satisfaction.

Challenges of Managing Canadian Employees In-House

Managing Canadian employees in-house can be challenging for US companies, particularly those unfamiliar with Canadian payroll laws and regulations. Some of the primary challenges include:

- Understanding Canadian employment laws: This includes minimum wage, overtime, and vacation entitlements, which can vary significantly between provinces.

- Managing payroll taxes and contributions: Accurately calculating and remitting CPP, EI, and federal and provincial income taxes can be complex and time-consuming.

- Ensuring compliance with labor laws: This involves adhering to employment standards and health and safety regulations, which are strictly enforced in Canada.

- Navigating the complexities of Canadian payroll: This includes understanding payroll deductions and remittances, which can be more intricate than in the US.

- Managing the risks associated with payroll errors: Mistakes in payroll processing can lead to penalties, fines, and strained employee relations.

To overcome these challenges, US companies can consider outsourcing their payroll services to a reputable provider or partnering with an Employer of Record (EOR) provider. This approach ensures compliance, reduces the risk of errors, and allows companies to focus on their core business activities.

Choosing a Canadian Payroll Service Provider

Choosing a Canadian payroll service provider can help US companies navigate the complexities of Canadian payroll and ensure compliance with local regulations. When selecting a provider, US companies should consider the following factors:

- Expertise in Canadian payroll laws and regulations: The provider should have a deep understanding of Canadian payroll requirements, including CPP, EI, and federal and provincial income taxes.

- Ability to accurately calculate and process payroll deductions and remittances: Ensuring accurate and timely payroll processing is crucial to avoid penalties and maintain employee satisfaction.

- Compliance with local employment regulations: The provider should be well-versed in minimum wage, overtime, and vacation entitlements, ensuring your company adheres to all legal requirements.

- Ability to manage payroll taxes and contributions: The provider should handle all aspects of payroll taxes, including calculating, deducting, and remitting CPP, EI, and income taxes.

- Reputation and experience: Look for a provider with a proven track record of delivering reliable payroll services to US companies with Canadian employees.

By choosing a reputable Canadian payroll service provider, US companies can ensure that their payroll is managed efficiently and effectively, reducing the risk of errors and penalties.

Partner with Syndesus, Your Payroll Service Provider, for Seamless Canadian Expansion

Syndesus specializes in assisting US companies with establishing and managing Canadian entities. Our expertise in Canadian payroll ensures that your company remains compliant and operates as financially efficiently as possible. We handle everything from payroll processing to navigating tax laws so you can focus on growing your business.

Syndesus can also help US companies hire Canadian employees, ensuring compliance with local laws and regulations.

Are you looking to ensure compliance and save money as you expand into Canada? Contact us to learn more about how we can support your success in Canada.